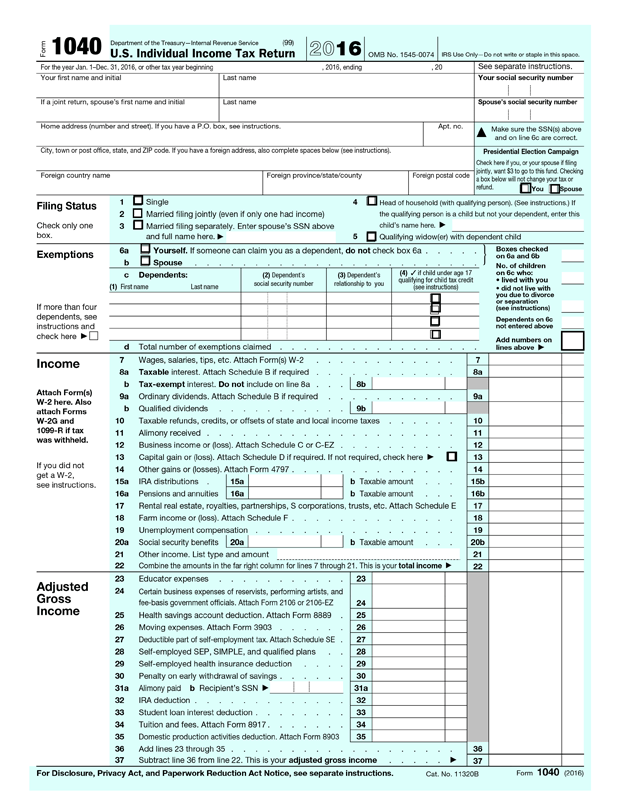

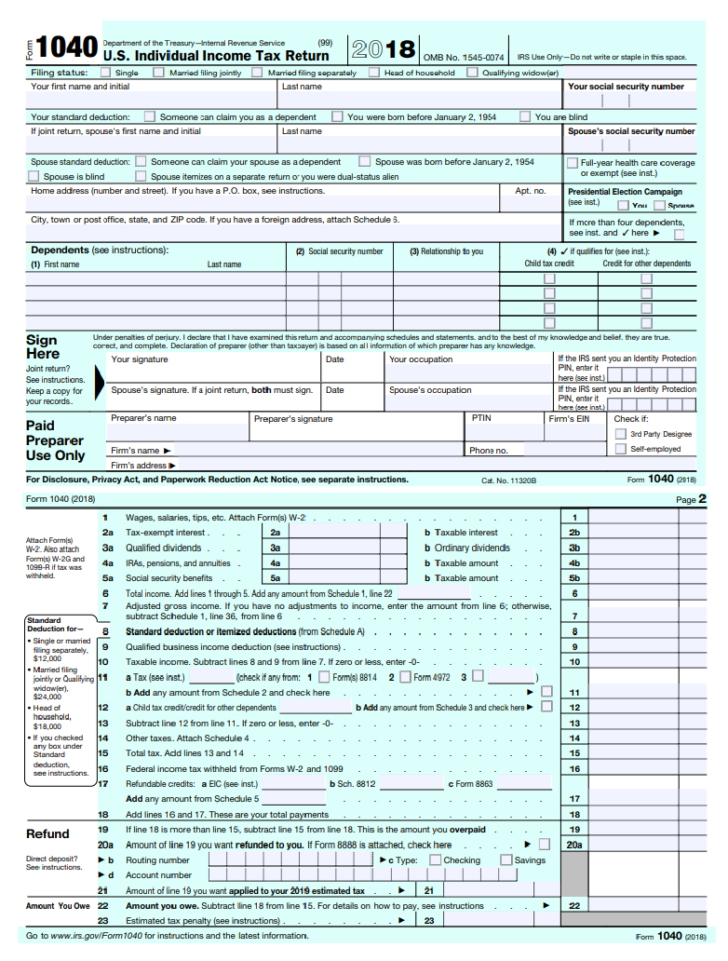

Please note that a tax return (IRS Form 1040) is not acceptable documentation. Have it sent to you so that you can upload a copy of it through FAST. Because the tax transcript will not include your USC ID number, DO NOT have it sent directly to USC. taxpayers to file an annual income tax return.

If you have any questions about your Form 1095-B, contact UnitedHealthcare by calling the number on your ID card or other member materials. Complete the 1095B Paper Request Form and email it to your health plan at the email address listed on the formĪ Form 1095-B will be mailed to the address provided within 30 days of the date the request is received.Call the number on your ID card or other member materials.Members can view and/or download and print a copy of the form at their convenience, if desired.Īdditionally, a request for a paper form can be made in one of the following ways: How to find or request your Form 1095-Bįorm 1095-B will still be produced for all UnitedHealthcare fully insured members and will continue to be made available on member websites, no later than the annual deadline set by the IRS. Members living in states with laws that require reporting of health coverage will continue to receive a paper copy of the Form 1095-B for state filing tax purposes. Therefore, individuals no longer need the information on the Form 1095-B to file a federal income tax return. for federal income tax purposes in effect for the 2020 income tax year. Under new law that became effective beginning with the 2019 tax year, the IRS penalty for not having health coverage was reduced to zero. Form 1040X (Amended Federal Income Tax Return) or Form 1045 (Application for. Most fully insured UnitedHealthcare members will no longer automatically receive a paper copy of the Form 1095-B due to a change in the tax law.

0 kommentar(er)

0 kommentar(er)